Year of 8 FREE Round Trip Flights for Both of Us!

I think the Southwest Airlines Companion Pass is the BEST cheap trick to travel. In 2016, we managed to take 8 free flights using all points for my husband’s flights and the Southwest Companion Pass for my free flights. The only thing we had to pay was $10 per ticket; and $69 plus $99 for the credit card annual fees that helped us get the pass. I estimate we saved $3,850 in air fare!

How We Earned A Year of Free Flying with the Southwest Companion Pass

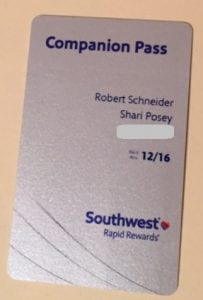

We spent 2016 flying on Southwest Airlines with free points and the Companion Pass. The Companion Pass enables the Rapid Reward member who earned the pass to choose a companion to go along free wherever that member flies on the same flight. The member with the pass can swap out up to three companions. To earn the pass you must fly a huge number of flights or earn 110,000 Rapid Reward Points OR by signing up for 2 Chase Southwest credit cards that each has 50,000 bonus sign up points–that’s how we do it! This is our second time qualifying for the Companion Pass.

Bob and I operate as a team and we alternate years that we each get the pass. It took us a while to learn how to get the pass and develop our best strategy. For example, I earned the pass in December 2013 at the end of the year so it was valid for a month in that year and all 12 months of 2014. In 2015, Bob got the pass towards the end of the year and it was good for all of 2016. THIS YEAR, I will try to get the pass early in the year so we will get it for 2017 & 2018.

There are 4 Chase Southwest Rapid Reward Credit cards that each offer 50,000 sign up points from time to time. Two of the cards are personal; two are business. Since Bob and I own our own business we can utilize those options. We each sign up for the cards individually, NOT together as authorized users. You have to search to find Chase application pages for the 50k bonus–I have found links on blogger sites and on Flyertalk’s Forum where individuals provide “invitation codes” for links to the 50k bonus cards. After you sign up for the cards and meet the spending requirements, you will have to spend a little more to reach 110,000 to get the Companion Pass. We meet the additional spending requirement by shopping through the Rapid Rewards Shopping Portal, which gives additional bonus points per dollar spent, and by going to restaurants with Rapid Reward’s Dining Program.

It’s very important to know Chase only allows you to have the bonus once every 24 months so alternating between my husband and me works well. Additionally, Chase has heavy restrictions about the number of credit cards you can get in a 24 month time period so if you want to get the Companion Pass you have to plan your credit card sign-up strategy carefully. The Points Guy has a detailed blog post about these rules.

Free Flights in 2016 with the Southwest Companion Pass–8 Round Trips TRIPS for Two People!!

Here are all 8 trips we took in 12 months using Bob’s free points from the credit card sign up offers and me using his Southwest Companion Pass. During the years we get the pass, we focus on travel almost solely to Southwest Airlines destinations rather than going to Europe, etc.

February 2016–We flew from Orange County to Cabo San Lucas, Mexico. We also used our new Hyatt credit cards to earn 2 free nights (total 4 nights) for each of us at the Ziva Los Cabos all-inclusive resort. Here is my review of our Cabo trip.

April 2016–We flew from LAX to Ft. Lauderdale, rented a car and drove to Key West. In Key West we each used our annual free nights with our IHG Priority Club credit card to stay at Crowne Plaza La Concha. We also stayed without points at two other hotels along the way. Here is my review of our Key West trip.

May 2016–We flew from LAX to Portland. The first night we stayed out at the airport using Club Carlson Points at the Radisson, explore downtown for a day and headed to the coast. The coast was amazing! We finished off our quick trip with a day of wine tasting on our way back to Portland to fly home. Here is my review of our Portland and Oregon Coast trip.

August 2016–We flew from Long Beach to San Francisco and stayed 2 nights at the Holiday Inn Express & Suites at Fisherman’s Wharf using IHG Priority Club points. Our primary purpose of this trip was to meet up with old friends from our 500-mile walk of Spain’s Camino de Santiago in 2015. Here is our review of our favorite trip of all time, “the Camino!”

October 2016–In early October we flew from LAX to New York City (La Guardia Airport) for 3 nights in Manhattan to visit a friend and a night in Hartford, Connecticut to visit an old friend. We took a bus from NYC to Hartford and flew back to LAX from Hartford. Here is a review of the Manhattan portion of our trip.

October 2016–We flew from LAX to Nashville for our nephew’s wedding. We paid for our stay at the Hampton Inn in Gallatin with cash. Unfortunately, the town where the wedding was held outside of Nashville has terrible hotel point redemption values.

November 2016–We flew from LAX to New Orleans for Thanksgiving and used our annual free nights and points from our Club Carlson credit cards to stay 3 nights at the Country Inn & Suites in the French Quarter. Here is my review of our New Orlean’s trip.

December 2016–We flew from LAX to Nashville for Christmas and stayed with family.

Our Strategy for 2017 to Get A New Southwest Airlines Companion Pass

On January 3, 2017 I applied for the Chase Southwest Airlines Premier Business card for 50k points via a link on MillionMileSecrets blog. After I submitted the application the screen said I will receive an answer about approval in 7-10 business day. Three days later the card showed up on my Chase account online. Awesome! After I finish the spend for this card, I will wait a month, cross my fingers and apply for a personal card. I’ll keep you posted on my progress!

Loved all these ideas…! But I have a concerning question. How does opening all these new credit cards affect your credit rating? And do you keep them all open or close some after you’ve used the points etc? And how does closing so many affect your credit?

Thank you.

Hi Beth,

Good question! At this moment I have 2 business cards and 10 personal cards. I only have 2 cards that I have kept for a number of years; all of the other cards I cancel after one year for the most part. All I can say is that when I started collecting points through credit card bonus offers in 2010 my credit score was 710 and now it’s 840. I don’t know if the score increase is because of the cards or not. I pay all cards off every month and never carry a balance. I know that the more credit you are extended and the less credit you actually use, your score goes up. Also, I do not use all the cards all the time. For the most part, I use the card in order to get the bonus and then I put it away until the annual fee is due.

About when you must use the points…different reward programs have different rules about closing the account if you have points. For example, some Chase cards that have Ultimate Reward points MUST be used or transferred before you close the credit card account or you will lose them. However, Southwest Airlines allows you to keep the points as long as they are in your account.

Hey nice post. I hope it’s alright that I shared it on my FB, if not, no worries just tell

me and I’ll remove it. Either way keep up the good work.